Willkommen

Klinik für Gynäkologie und Geburtshilfe

An unserer Frauenklinik behandeln und betreuen wir Patientinnen mit den unterschiedlichsten Diagnosen. Wir bieten Ihnen eine professionelle sowie persönliche Behandlung.

Chefarzt

Dr. Claudius Fridrich

Facharzt für Gynäkologie und Geburtshilfe

| Tel | 0221 7491-8288 |

| frauenklinik.kh-heiliggeist(at)cellitinnen.de |

Die Frauenklinik

- Team

- Sprechstunden/Kontakt

- Gynäkologie

- Gynäkologisches Krebszentrum

- Endometriosezentrum

- Brustzentrum

- Leistungen

- Unterstützungsangebote

- Komplementäre Medizin

- Yoga bei Krebs

- Kooperationspartner

- Brustkrebsfrüherkennung

- Infos Niedergelassene

- Qualitätssicherung

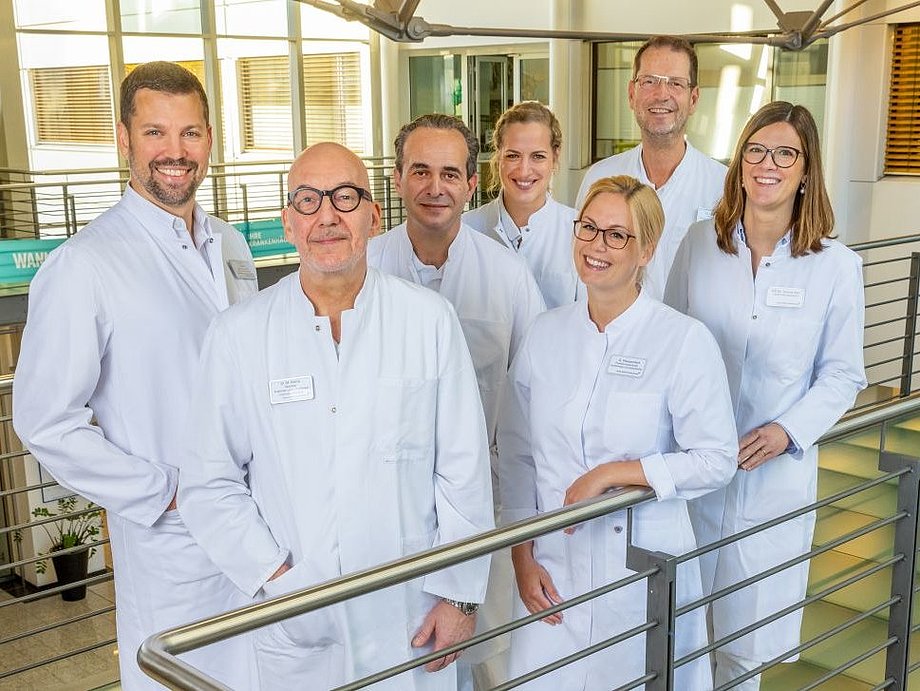

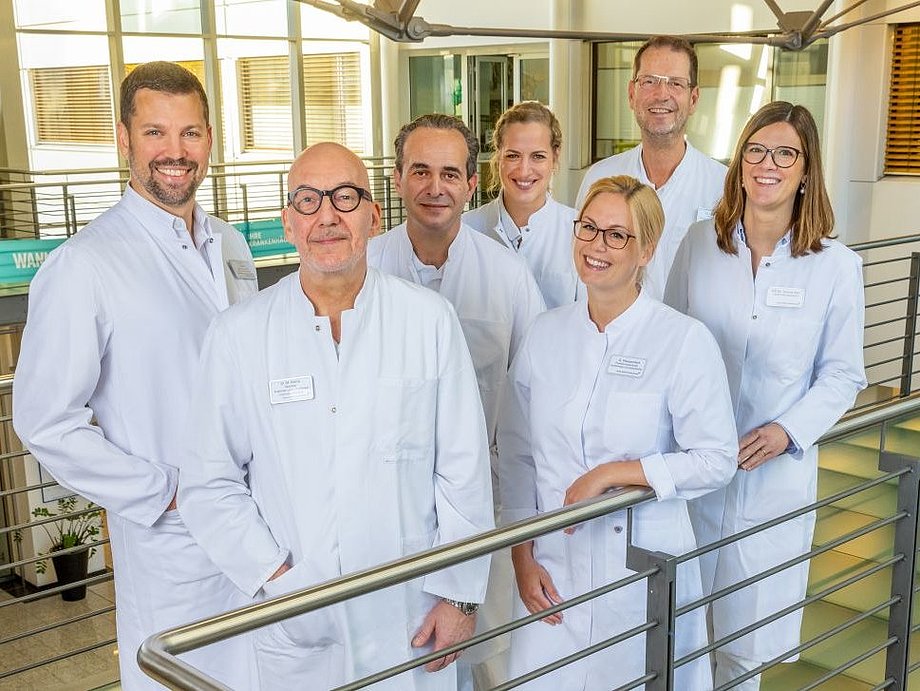

- Team

- Geburtshilfe

- Rund um die Geburt

- Virtuelle Kreißsaaltour

- Kreißsaalinfoabend

- Hebammenkreißsaal

- Anmeldung zur Geburt

- Elternschule/Kursangebote

- Babygalerie

- Broschüren zum Download

- Für Ärzte

- Weiterbildungsermächtigungen

- Infos für Studierende

Willkommen in der Frauenklinik

Wir für Sie

Wir freuen uns, dass Sie mit Ihrem Anliegen zu uns gefunden haben. Als Ihre Frauenklinik in Köln bieten wir hochprofessionelle, medizinische Versorgung nach neuesten Standards – in einer Atmosphäre, in der Sie sich rundum aufgehoben und wohlfühlen können. Bei uns sind Sie menschlich und medizinisch in guten Händen.

An unserer Frauenklinik behandeln und betreuen wir Patientinnen mit den unterschiedlichsten Diagnosen. Wir möchten Ihnen mit unserer medizinischen Kompetenz, modernsten Verfahren und Medizintechnik eine schnellstmögliche, professionelle sowie persönliche Behandlung anbieten, die Ihren Bedürfnissen und Wünschen entspricht.

Sehen Sie hier unsere virtuelle Kreißsaal-Tour

Für welchen Fachbereich interessieren Sie sich?

Fragen Sie jetzt online einen Termin an

Kontaktieren Sie uns über unser Terminformular und wir melden uns gerne bei Ihnen zur Terminvereinbarung.

Kontakt

Die Frauenklinik

Klinik für Gynäkologie und Geburtshilfe

Cellitinnen-Krankenhaus Heilig Geist

Graseggerstr. 105

50737 Köln-Longerich

| Tel | 0221 7491-8289 (Sekretariat) 0221 7491-8288 (Chefarzt Sekretariat) 0221 7491 1606 (Elternschule) |

| frauenklinik.kh-heiliggeist(at)cellitinnen.de | |

| Fax | 0221 7491-8052 |

Ergänzen Sie uns!

Wir bieten Ihnen viele berufliche Perspektiven an. Detaillierte Informationen über unsere Stellenangebote finden Sie hier: